No, I’m not referring to the movie from 1979, but the theme of the movie about the coverup of a nuclear meltdown at a nuclear power plant is much like the real China coverup over the COVID-19 plague that is causing such catastrophic damage to the entire world. You have undoubtably heard that more and more evidence is coming to light that the virus originated from a lab in Wuhan, China, and that the communist government of China deliberately hid critical information about it from the rest of the world. As a result, there are cries from those in Congress and many among our citizenry for the US to take retaliatory action against China and understandably so. There are several proposals as to what the US should do, and although I would like to see these actions taken, we need to hit the “pause” button and carefully and soberly consider their ramifications and not take actions in a “knee-jerk” fashion and later suffer damaging unintended consequences (which often happens with such hasty government actions, e.g., the invasion of Iraq).

Perhaps, in my humble opinion, the most dangerous action being floated by several is the cancellation of the US debt held by China. At first, I also promoted this idea as China has inflicted trillions of dollars of damage on our economy and the lives of millions and millions of our citizens. It made perfect sense as the estimated value of the damaged caused by China’s deliberate actions is far greater than the amount of our debt they hold. Consider, however, these untended consequences that are far-reaching in scope both in time and outside of China:

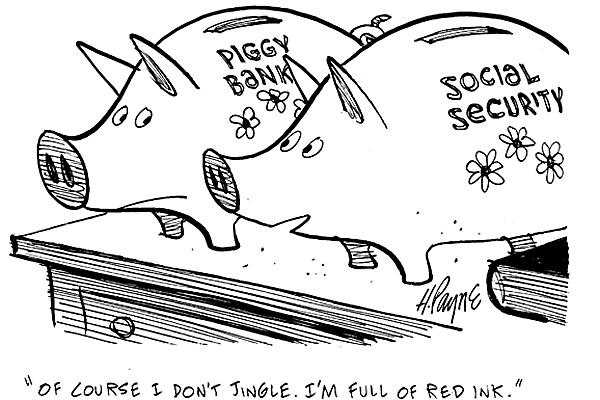

- The US has never – never – defaulted on its debt; it has always been considered a “safe haven” for investors around the world looking for someplace to “park” their money when threatening economic times come. If we default on paying our debt to China to retaliate against actions we consider egregious to our welfare, then other individuals and especially foreign governments and companies may hesitate to loan us money and prop up our proliferate spending as they may fear we could default on their loans if they ever got cross-ways with the US. Without other nations willing to buy our debt, then we would have economic devastation.

- Without this debt purchasing by others, with our bloated deficits, inflation would soar to levels unimaginable (think the Weimer Republic in pre-Nazi Germany). This would be further exacerbated if the leading world economies pushed even harder to replace the dollar as the world’s reserve currency (such as what BRIC – Brazil, Russia, India, China – have been pushing for some time now).

- With such weakened currency, our entire economy with all of our “safety net” programs that so many of us depend on would implode and the human misery would be catastrophic. With this would come total societal anarchy.

Now you may think after a two-year hiatus from writing my essays I’ve gone completely bonkers, but the laws of economics and geo-political high-level finances are as certain as any other laws of science. The only good thing that could come of such a scenario as I’ve warned about above would be it would sure stop a lot of the unconstitutional spending that has been going on by the federal government for well over a century; problem is, it would probably be too late to stave off the destruction that would come about.

So, do we just give China a pass on their duplicity? Is the communist government of China going to be allowed to skate by on their actions? Hardly; there are things that could be done, but I’ll discuss them in a subsequent essay – hopefully sooner than two years from now!