There are many things that I’ve come to find hard to believe, but I was squarely confronted with another one this past week when my wife and I attended a two evening seminar on filing for Social Security and Medicare benefits. I’m not supposed to be old enough to be concerned with this issue yet there I sat! However, I did learn just how convoluted this entire setup is and how it is not hard to believe how these programs will destroy our country if they are not addressed and dealt with. Discounting the fact for the moment that such systems are not within the purview of government and outside the its Constitutional authority, we are in too deep to terminate them cold turkey; but we as a country must understand the truth behind them and wean ourselves off of them over the next few generations.

There are several myths about social security that have become ingrained in our social conscious. First is the idea that it was designed to be a pension plan for retirement; that was the bogus lie used to “sell” the concept to the populace in 1937. Yet when the Supreme Court stuck the law down as unconstitutional, FDR’s attorneys argued that it was really just a general tax and so it was allowed to stand.

A second myth is that the monies contributed are “held” in a trust fund for us. There is no social security trust fund as the monies withheld from our paychecks and matched by our employers has gone into the general treasury and been spent.

A result of this first myth is the common attitude among retirees and those like myself who are closing in on that mile marker that those monies are “my money – I’m entitled to it because I paid into this plan.” Again, that is based upon the belief that Social Security was intended to be a pension plan, which behind the scenes it was not. Want proof? When the law went into effect, the average lifespan for the most Americans was 64 years of age; the retirement age to collect Social Security benefits – 65 years of age! The government was betting that for the most part, it would collect more in taxes than it would have to pay out because most would die before collecting their benefits! Such is the cynical tyranny of socialist governments.

According to the Center on Budget and Policy Priorities, in 2015 Social Security benefits amounted to 24% of the federal budget. Medicare, Medicaid and other similar insurance programs added another 25%. A grab bag of other safety net programs took up yet another 10%. The problem – these percentages are only growing exponentially at a rapidly increasing rate. Witness how the projected date by government economists as to when these systems will be “broke” is a target constantly being updated to a date closer and closer to our immediate future.

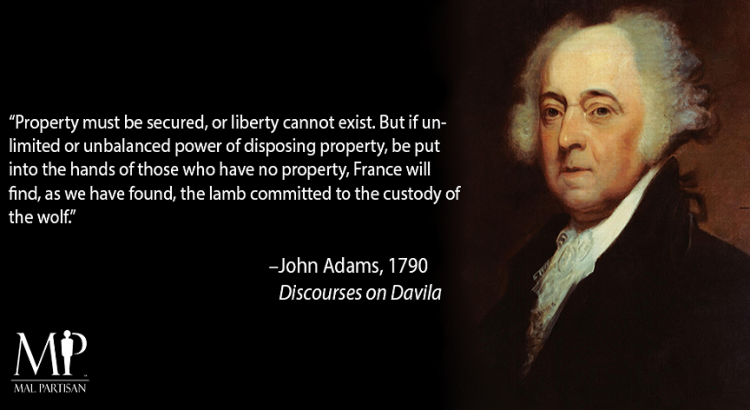

I hope that my health will permit me to work for many more years so that I will be able to forego my benefits and do a small part of saving the financial future of my children and grandchildren, but who knows what the future may hold? This one thing I do know will hold – these programs are not sustainable and our politicians must put our future ahead of their political futures by addressing this looming time bomb. John Taylor said it well in regards to pension and welfare programs which had already started in the early 1800s’:

“That the error of trusting republican governments with this tyrannical power [i.e., creating pension and welfare programs], has probably caused their premature deaths, because they are most likely to push it to excess” (Construction Construed and Constitutions Vindicated, p. 341, published 1820).

-April 29, 2016