This year, in addition to receiving your W-2 tax form from your employer, you are going to receive a Form 1095-C. This is a form that is now required under the so-called “Affordable Care Act.” Unless you work in your company’s payroll or benefits’ departments, you are probably not aware of the burden these departments are experiencing in producing these forms. As I am a payroll and benefits professional and have just finished completing these forms for my employer, allow me to share just how burdensome these reporting requirements are on businesses. (Oh, by the way, the Act also requires your insurance carrier to send you a Form 1095-B as well).

The form requires employers to indicate on one line whether or not you were offered insurance coverage that met the minimum standards as required by the Act. There are a number of different codes that must be used, depending upon certain parameters. Unless the code is the same for all twelve months of the year, the proper code for each month must be recorded in a box for that month. On a second line, businesses are required to record in a box for each month, unless it was the same for all twelve, whether you enrolled in the coverage offered, or if not, the appropriate code indicating why you didn’t (e.g., you were not an employee at the time, you were an employee but was in a probationary period, etc.). Obviously the codes in each month’s box on these two lines must match up (in other words, you could not have the code for having been offered insurance on one line if on the second line the code indicates you were not yet an employee).

If your company has the misfortune to be “self-insured”, it must also list the names of the dependents covered under the plan as well as their social security numbers (the employer is expected to make at least three “good faith” efforts to obtain these numbers in case they are not in a database kept by the company).

Unless you work for a large company that has a robust payroll/benefits accounting system that has been modified to track and produce this data, this information is not readily available in their databases. Consequently it must be compiled from perhaps multiple places into an Excel spreadsheet for example and then merged into a template (that you have to create) so that you can then print the information onto the required form in the proper boxes.

Once these are distributed to the employees, the employer must then report a summary of this information on a Form 1094 which requires a month-by-month accounting of how many employees were active on a particular day of the month and how many of them were eligible for insurance as of the first of that month. This form and a copy of all of the Form 1095-Cs must then be forwarded to the IRS so that the Obamacare “Gestapo” can be sure that you have the required coverage and if not, to impose a penalty – oh excuse me Chief Justice Roberts – a tax on you for your failure to acquire the mandated minimum coverage (or fine your employer for not offering the required insurance).

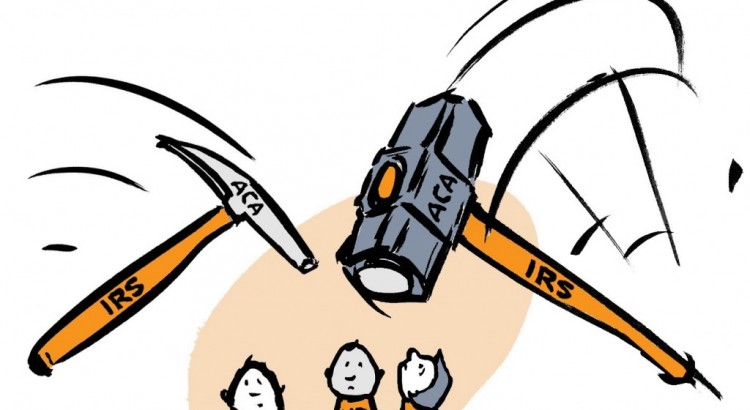

So now you have an insider’s perspective on the regulatory hammer that has fallen on both your employer and insurance carrier. With these compliance costs hammering businesses and insurers, is it any wonder that premiums are going up and businesses are reluctant to hire more full-time employees or have the profits necessary to expand and hire?

-January 22, 2016